The 9-Minute Rule for G. Halsey Wickser, Loan Agent

Table of ContentsAbout G. Halsey Wickser, Loan AgentSee This Report about G. Halsey Wickser, Loan AgentThe Definitive Guide to G. Halsey Wickser, Loan AgentEverything about G. Halsey Wickser, Loan AgentThe Ultimate Guide To G. Halsey Wickser, Loan Agent

They may bill loan origination costs, in advance costs, loan administration costs, a yield-spread premium, or just a broker compensation. When working with a home mortgage broker, you need to clarify what their charge structure is early on while doing so so there are no shocks on closing day. A home loan broker commonly only gets paid when a lending closes and the funds are launched.Most of brokers do not cost consumers anything in advance and they are usually risk-free. You need to use a home loan broker if you wish to discover accessibility to home car loans that aren't conveniently promoted to you. If you don't have fantastic credit report, if you have an unique loaning situation like having your own organization, or if you just aren't seeing mortgages that will certainly help you, then a broker could be able to obtain you access to car loans that will certainly be useful to you.

Home loan brokers may likewise be able to assist lending seekers get a reduced rate of interest than most of the business financings supply. Do you need a home loan broker? Well, collaborating with one can conserve a consumer time and initiative during the application procedure, and potentially a great deal of money over the life of the car loan.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

An expert mortgage broker comes from, negotiates, and refines household and business mortgage loans in behalf of the client. Below is a 6 factor overview to the services you must be used and the assumptions you must have of a certified home mortgage broker: A mortgage broker supplies a large range of home loan from a variety of various loan providers.

A mortgage broker represents your rate of interests as opposed to the rate of interests of a loan provider. They ought to act not only as your agent, yet as an educated consultant and issue solver - mortgage lenders in california. With accessibility to a variety of mortgage items, a broker has the ability to provide you the best value in terms of passion rate, repayment amounts, and funding items

Many circumstances demand even more than the simple usage of a 30 year, 15 year, or adjustable rate mortgage (ARM), so cutting-edge mortgage strategies and advanced remedies are the advantage of dealing with a skilled home mortgage broker. A home loan broker browses the client via any kind of circumstance, taking care of the process and smoothing any bumps in the road in the process.

The Greatest Guide To G. Halsey Wickser, Loan Agent

Debtors that find they need larger loans than their financial institution will certainly accept likewise take advantage of a broker's knowledge and capability to effectively get funding. With a home mortgage broker, you only need one application, as opposed to completing kinds for each and every specific loan provider. Your home loan broker can offer a formal comparison of any kind of lendings suggested, directing you to the info that properly portrays expense differences, with current prices, factors, and closing expenses for every finance showed.

A credible mortgage broker will divulge how they are spent for their services, in addition to detail the complete expenses for the lending. Individualized solution is the distinguishing element when selecting a home mortgage broker. You need to anticipate your home loan broker to help smooth the method, be offered to you, and advise you throughout the closing procedure.

The journey from fantasizing concerning a brand-new home to actually possessing one might be full of challenges for you, specifically when it (http://dailycategories.com/directory/listingdisplay.aspx?lid=62317) comes to protecting a mortgage in Dubai. If you have been assuming that going directly to your bank is the ideal path, you could be losing out on a simpler and possibly more useful choice: collaborating with a home loans broker.

10 Easy Facts About G. Halsey Wickser, Loan Agent Explained

Among the substantial benefits of utilizing a mortgage consultant is the expert economic suggestions and crucial insurance advice you get. Home loan professionals have a deep understanding of the different monetary items and can assist you pick the appropriate mortgage insurance. They ensure that you are adequately covered and provide suggestions customized to your financial scenario and lasting objectives.

This process can be daunting and lengthy for you. A home mortgage brokers take this problem off your shoulders by managing all the documentation and application processes. They understand specifically what is needed and make certain that whatever is completed accurately and on time, reducing the threat of delays and mistakes. Time is money, and a home loan broker can save you both.

This suggests you have a much better possibility of locating a mortgage in the UAE that flawlessly suits your needs, including specialized items that may not be readily available via conventional banking networks. Browsing the home loan market can be confusing, especially with the myriad of products available. An offers expert advice, aiding you recognize the advantages and disadvantages of each alternative.

Examine This Report about G. Halsey Wickser, Loan Agent

This professional guidance is important in securing a home mortgage that straightens with your economic objectives. Mortgage consultants have developed connections with lots of loan providers, providing considerable negotiating power. They can safeguard much better terms and prices than you could be able to get by yourself. This discussing power can lead to significant cost savings over the life of your mortgage, making homeownership much more affordable.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Susan Dey Then & Now!

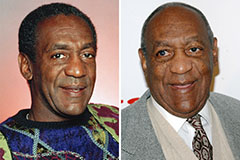

Susan Dey Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!